The New Budget

- Juliet Frerking

- Mar 8, 2019

- 2 min read

Updated: Jul 15, 2019

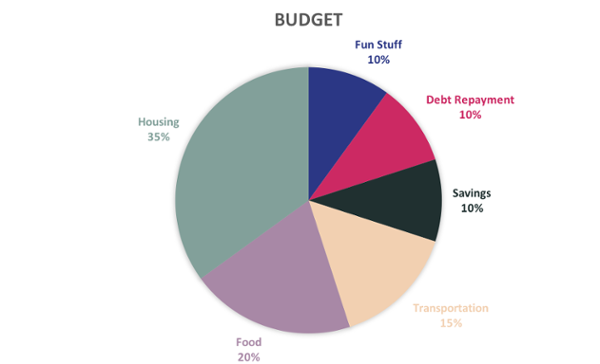

Everyone knows they should be saving more. According to most financial advisors, Americans should be targeting a breakdown that looks something like this:

However, it can be tough for most of us to stay within these guidelines, and, often, savings is the piece that gets cut. The 50-30-20 rule from Sen. Warren is often an easier way to visualize this:

The 50-30-20 Rule: Needs, Wants and Savings

In other words, spend half of your take-home income on things you need like housing, transportation, and food. Reserve another 30 percent for things you want — trips, clothes, and entertainment. Use the remaining 20 percent to pay down debt or to sock away into savings and retirement funds.

Healthcare As a Rising Expense

According to a recent study released by Health Affairs, by 2026, the United States will be spending nearly 20% of its GDP on healthcare-related costs. While this won’t directly correlate to individuals having to allocate 20% of every paycheck accordingly, the increase in costs overall are very real. The United States already spends more on healthcare than any other nation.

Investment firms like Fidelity are starting to revise their sample budgets for individuals to account for unexpected healthcare costs, particularly for senior citizens. According to the CMS, the average American spent $10,348 on healthcare in 2016, a dramatic increase from $7,700 per person in 2007.

Americans need a way to bring down costs

It’s no secret that healthcare can be confusing. As an industry, it has little or no price transparency, and consumers often are surprised at a bill after the procedure has taken place. Imagine walking into any retail store and purchasing an item with no concept of what it will cost. (!)

That’s where TouchCare comes in. We help our members be smart consumers of healthcare. Through new tools like our Cost Comparison, we do the research first. Using proprietary tools, we investigate what a “good rate” is for a procedure or office visit. Then, we take it a step further by calling the insurance company on our members’ behalf, to confirm rates before the visit takes place.

Accuracy is of utmost importance to us. Finally, we call the doctor’s office or hospital to get a quote directly from them and compare this to what the insurance company reported. If there’s a discrepancy, we investigate. We do all the legwork for you before the visit happens.

And finally, if there’s a discrepancy after the visit, we make it right. We back our price quotes with a money-back guarantee, up to $500 if the discrepancy was caused by TouchCare error.

At TouchCare, we know healthcare costs are becoming more of a part of every household’s budget. We want you to be a smart consumer. We’re on your side, not the insurance company's.

Comments